Preview table of contents and sample page

About this Report

This report focuses on how fans extend their engagement in sport through mostly virtual experiences that encompass: sports betting, fantasy sports, video games, esports, sports collectibles and sports-themed bars. In 2023, worldwide spending on these six core areas of sports entertainment totaled nearly $375 billion. The U.S. accounted for 41% or $154 billion of the total. The report provides annual spending data and forecasts and analyzes the pre-and post-COVID recovery performance of each of the six segments.

In 2023, legal Sports Betting worldwide totaled $261 billion. However, this figure does not account for the many billions of dollars bet illegally, at unregulated, “off-shore” sports betting sites. Since first legalized in 2018 in America, sports betting has been the fastest growing segment of the of the sports industry in the U.S. In just 5 years, sports gambling revenues grew from $13.1 billion in 2029 to $124.5 billion in 2023, accounting for nearly half of the world’s total. Our report examines how sports leagues around the world and in the U.S. have embraced sports betting as a new, robust revenue stream. It also calls attention to the “dark side” of sports gambling and the growing addiction problem.

Fantasy Sports allow fans to own, manage and coach their own virtual sports teams. What began as a hobby among friends or workmates, has grown into a $31 billion global business. The report examines the factors that have led to the rapid growth of this popular form of fan engagement. India’s largest fantasy platform has over 100 million users, while 69 million North Americans participate in fantasy sports. Market demand has been driven by the prolific growth of sports fantasy betting platforms, like Dream 11 in India, Mondogoal in Europe and Draft Kings and FanDuel in the U.S. These private gaming companies offer Daily Fantasy Sports (DFS) allowing users to compete against each other on a pay-to-play basis for daily for cash prizes. While extremely popular, six states have banned DFS as a disguised form of gambling. Nonetheless, players in the U.S. spent close to $10 billion in 2023 on fantasy sports gaming.

Competitive video gaming or Esports has become a global phenomenon. As video technology became more affordable, gaming became more accessible, attracting more players, larger audiences and corporate investment. The report examines the disruptive impact of the global pandemic in 2020 from which the U.S. esports market has not fully recovered. While viewership has grown, many American esports competitive teams have been unable to monetize their engaged fans and sponsors. Demographics are provided for those who play in and view esports tournaments, noting women’s growing share. The report provides contrasting measures of how annual esports revenues are accounted for, comparing New Zoo’s most often cited “events-only” ($1.62 billion) measure with Ahn’s more robust esports ecosystem model ($24.9 billion) global estimate.

This section of the report focuses on capturing the amount consumers spend annually on Sports-themed Video Games, including the amount spent on game content, downloads, and in-game spending related to sports play. The video games industry identifies “sports” as one of many genres, including action, shooter and strategy. In 2023, the sports category’ share of all video game sales was 11.1%, fourth highest behind 22.2% action, 17.8% shooters and 17.0% strategy. The 11.1% share was used to calculate the annual revenues of sports-themed sales both globally and in the U.S. The sports category accounted for $28 billion of the world’s $252 billion total spending and $7.30 billion of the $66 billion spent in the U.S. The report tracks the growing popularity of video gaming that has become more digitally accessible, affordable and youthful. sales performance of sports games globally and in the U.S. In 2023, 3.34 billion around the globe were identified as “gamers,” nearly a billion more than in 2018. In 2022, four of the top 15 selling video games were sport games, led by Madden NFL 2023 (3rd) and FIFA 23 (7th).

Another rapidly growing sport entertainment sector is the Sports Collectibles market. The combined sales of player trading cards and game-used jerseys and sneakers has transformed what began as a hobby into a booming global industry, projected to exceed $200 billion in consumer spending by 2032. This section of the report examines the conditions and factors that have propelled the exceptional growth of the sports collectibles market.

Sports Bars have become an important social fixture in modern America. A place where fans can gather to cheer on their favorite teams in a comfortable atmosphere with friends and family. Over the past decade, sports bars have evolved from male-centric establishments (e.g., Hooters, Tilted Kilt) to more female and family-friendly environments. The U.S. version of sports-themed restaurants is the counterpart to sports/social pubs across Europe. In 2023, over 20,000 such pubs operated across Great Britain, with an increasing number of “American-style” sports bars featuring live U.S. sports and American food. Recently food industry journals, such as Restaurant Business, began recognizing Sports Bars as a standalone category, including them in their annual analysis of Top 500 restaurants. The number and annual revenue data provided by Restaurant Business and related sources were used to capture the sports bar sectors robust post-pandemic recovery and estimated annual revenues from 2018 to 2023.

Sports Industry Report

Contents

CONTENTS

Sample Page 1

Extending Sports Enjoyment

The Best-Howard Model (Figure 1.1) examines how fans engage the sports industry through mostly virtual experiences through its Sports Entertainment core area. Betting online, participating in or viewing esports competitions, joining a fantasy sports league, and playing sports video games with friends can all be accomplished on various electronic devices, allowing easy and around-the-clock fulfillment.

Sports fans worldwide spent $38 billion in 2023 on sports memorabilia, from trading cards to game-used items like balls and jerseys. The value of cards and iconic sports merchandise has appreciated so rapidly over the past decade that some collectors view sports memorabilia as investment-grade assets. Spurred by the rapid expansion of online platforms, the sports trading market is projected to reach over 100 million collectors globally within the next three to five years.

The Best-Howard Model also recognizes an increasingly popular sports engagement dimension, social dining experiences in sports-themed environments. Restaurant Business magazine recently recognized sports bars as a standalone industry category. In 2023, total sports bar sales reached $11.7 billion in the United States alone.

This chapter is devoted to providing an in-depth examination of the performance of each of the six segments, detailing spending trends over the past decade and projections for future growth.

Sports Entertainment Segments

Copyright 2025 The Business of Sports

01

Sample Page 18

Sports Entertainment

Fantasy Sports

Fantasy sports provide a unique experience, allowing fans to own, coach, and manage virtual sports teams. Fantasy team “coaches/managers” select real-life athletes or teams for whatever sports they are competing in, whether futbol in Spain or football in America. Like real-life sports, coaches are allocated a budget (a “salary cap”) to build their rosters. The team’s success is determined by how well the selected players perform during regular season games, such as the number of goals scored in soccer or the number of touchdowns in American football.

Fantasy sports are digital engagement platforms, based entirely on real-life sports matches, where users build virtual teams with real players… that compete in officially sanctioned sports matches.

– Fantasy Sports: Creating a virtuous cycle of sports development.

Federation of Indian Fantasy Sports and Deloitte

From a fan engagement standpoint, fantasy play is very arousing. Fantasy players have a heightened commitment to the teams or players they choose. Not only do they pay attention to the performance of their teams and players, they also take into account the productivity of their competitors. Like real-life managers, they often adjust their rosters by determining the starting line-ups for each game and trading for or purchasing new talent. The personal and financial investment evokes for many players the emotional range of the classic tagline used to introduce ABC’s “Wide World of Sports, ”The thrill of victory… and the agony of defeat.” The intense joy and disappointment of the competitive fantasy sports experience has engaged hundreds of millions worldwide.

As a result, what began as a hobby between friends and workmates over 50 years ago has grown into a $31 billion global business, projected to reach $48.6 billion by 2027 (53). This section examines the factors that have led to the rapid growth of this dynamic dimension of fan engagement.

18

Copyright 2025 The Business of Sports

Sample Page 26

Sports Entertainment

The events’ streaming audiences are far larger than their live audiences. According to Esports Charts, the 126 hours of the 2020 League of Legends Tournament produced record-breaking viewership statistics: 3.9 million peak viewers, 1.1 million average viewers and 139.9 million hours watched (70).

The following video is provided exclusively for this publication by John Pierce, co-founder and Managing Partner of Player2, a leading gaming and esports consulting firm (Figure 1.15). He also serves as a Professor of Practice at Arizona State University, teaching the Business of esports. Before founding Player 2, Mr. Pierce spent 25 years as a senior marketing executive with the NHL’s Arizona Coyotes, the U.S. Olympic Committee, and as director of creative content for the Walt Disney Company. His video is full of valuable insights on topics such as: esports recovery from the COVID-19 pandemic, esports unique appeal to young audiences, its growing global footprint, and emerging market trends (e.g., co-streaming, globalization of team brands, shift to lifestyle brand orientation).

FIGURE 1.15

John Pierce's Insights on Esports

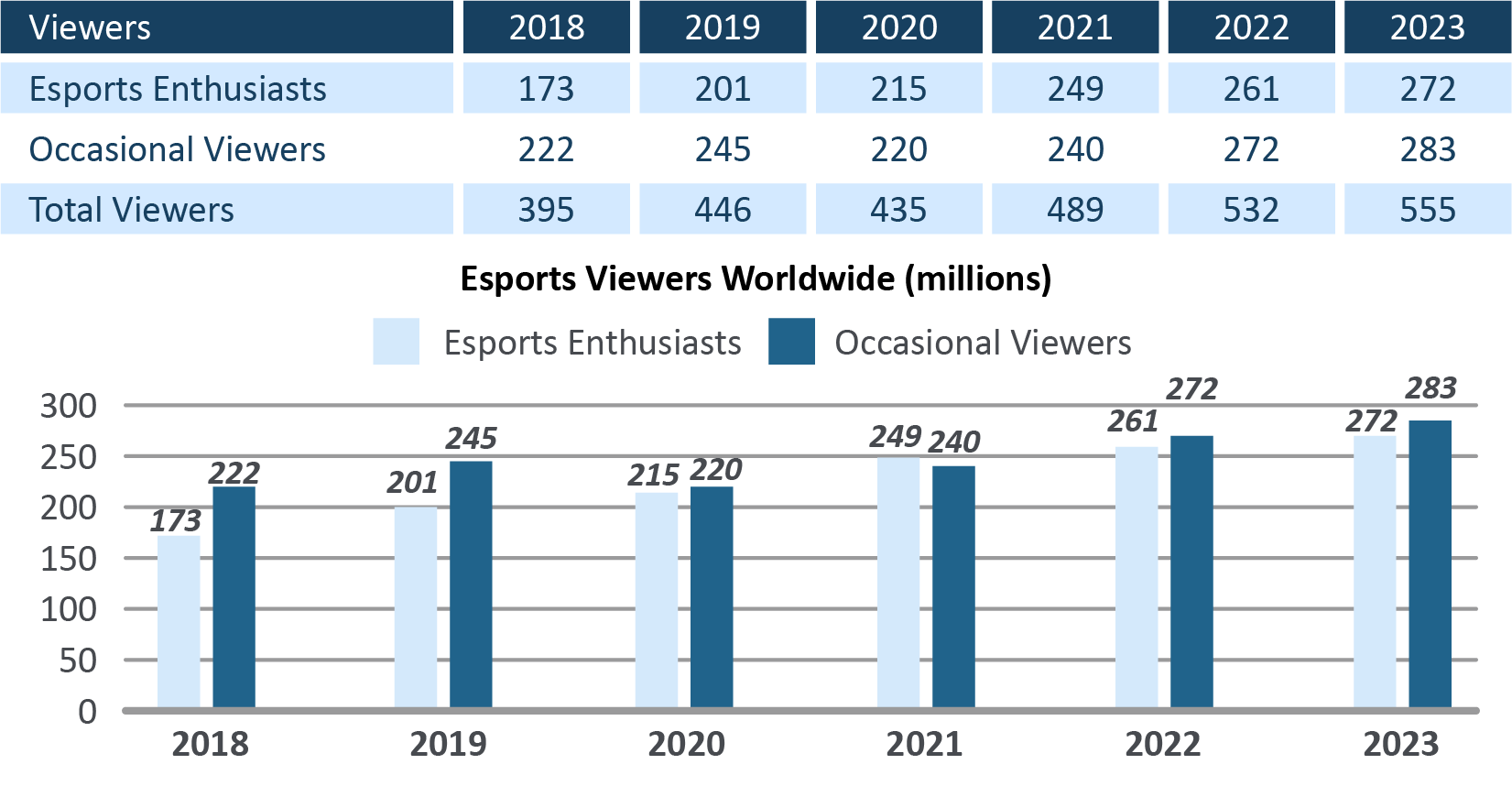

As shown in Figure 1.16, the number of people viewing esports worldwide has grown appreciably over the last five years. But, the annual viewing totals were disrupted by the COVID-19 outbreak in 2020. Due to the cancellation of competitions around the globe attendance declined. The relatively modest loss in 2020 reflects esports rapid recovery as many countries relaxed pandemic restrictions during the second half of that year.

FIGURE 1.16

Esports Viewers Worldwide, 2018-2023 (millions)

26

Copyright 2025 The Business of Sports

Sample Page 41

Sports Entertainment

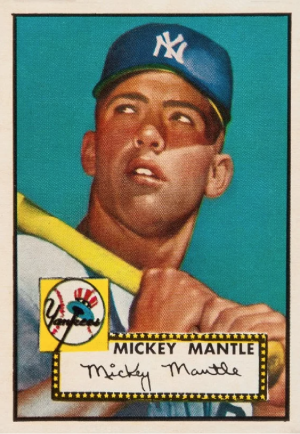

FIGURE 1.32

Mickey Mantle Rookie Card Sells for $12.6 million

Demand is also high for game-used items like balls, sneakers, and jerseys. In April 2023, at a Sotheby’s auction, a pair of signed Nike Air Jordan 13 shoes sold for $2.2 million, the most ever paid for a pair of sneakers (110). Jordan had worn the shoes in the second game of the 1998 NBA Finals. Michael Jordan brand collectibles remain very popular across several collectible categories. Two of the NBA great’s 1996 rookie cards sold for $738,000 each at a 2021 auction (102), an autographed 1997 Upper Deck card going for $1.44 million, and three pairs of game-worn sneakers fetching $1.47 million (Jordan Nike Air Ships), $615,000 (“Chicago” Air Jordan 1 worn by Jordan when he shattered a backboard) and $560,000 Air Jordan 1 classic. Vintage memorabilia attract even higher sale prices. In January 2021, a mint-condition 1952 Mickey Mantle baseball card sold for a record $5.2 million, topping Babe Ruth’s 1920 baseball jersey, which sold for $4.415 million (Figure 1.32). The $4.33 million paid for the Rules of Basketball was not far behind, written by the game’s supposed inventor James Naismith in 1891. The highest sports collectible sale price to date is $38.1 million for the 1962 Ferrari 250 GTO, driven by some of the world’s most iconic drivers in the European GTO series in the 1960s.

Fanatics is a company that has recently moved to take full advantage of the rapidly growing sports card market. Market Decipher forecasted in January 2024 that the sports cards sales will nearly quadruple from $14.8 billion in 2023 to $51.2 billion by 2032 (103). Applying the same aggressive business plan it used to claim a dominant share of the sports apparel market, Fanatics in less than 2 years has turned the trading card industry upside down (104). In a feature article in the Sunday New York Times, authors Jordyn Holman and Ken Belson, chronicle Fanatics effort to transform the sports card collectibles market. Their article describes the “playbook” employed by Fanatics to capture control of key segments of the retail trading card ecosystem. At its time of entry in 2022, the company invested hundreds of millions of dollars to become the exclusive long-term partners with Major League Baseball, the National Basketball Association, and the National Football League. They purchased Topps, the preeminent card making company, CG Packaging, the leading card printer, and PWCC, a prominent online marketplace for trading cards. The purchase of these three industry leading companies provided Fanatics with a direct distribution pipeline through Topps to thousands of retail card dealer shops, and a reliable, high-quality production capability. The long-term partnerships with the MLB, NBA and NFL ensure Fanatics with a dominant market presence. The agreements provide the company with control over the use of league and team logos on player cards representing all three leagues. As a result of this exclusivity, competitors are denied the use of official team-identifying symbols… making the “cards less attractive for collectors” (104). In 2023, the top leagues are expected to exceed $1.3 billion in card sales, led by Major League Baseball at $650 million (104). Holman and Belson report that Fanatics is well on its way to achieving an ever-increasing share of the sports card collectibles market (109). In just its third year since entering the market, Fanatics is projected to generated “well north” of $1 billion in revenues (104).

Fan engagement in the sports collectibles and memorabilia market is one of the fastest-growing segments of the global sports industry. What began as a hobby for sports enthusiasts in the United States has evolved into a booming global industry, projected to exceed $200 billion in consumer spending by 2032.

Copyright 2025 The Business of Sports

41