The record-breaking spending has been propelled by two primary factors:

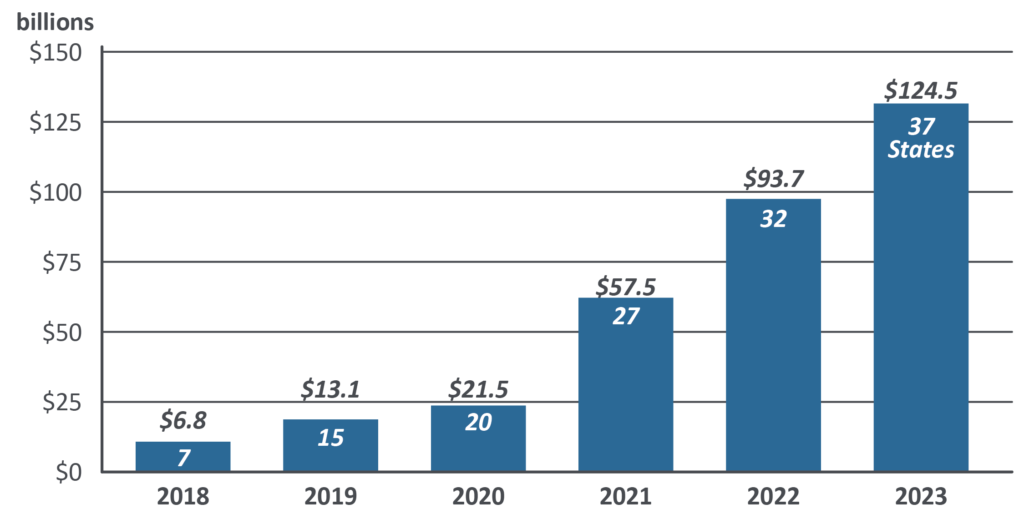

- Rapid growth of states that have allowed legalized betting sites.

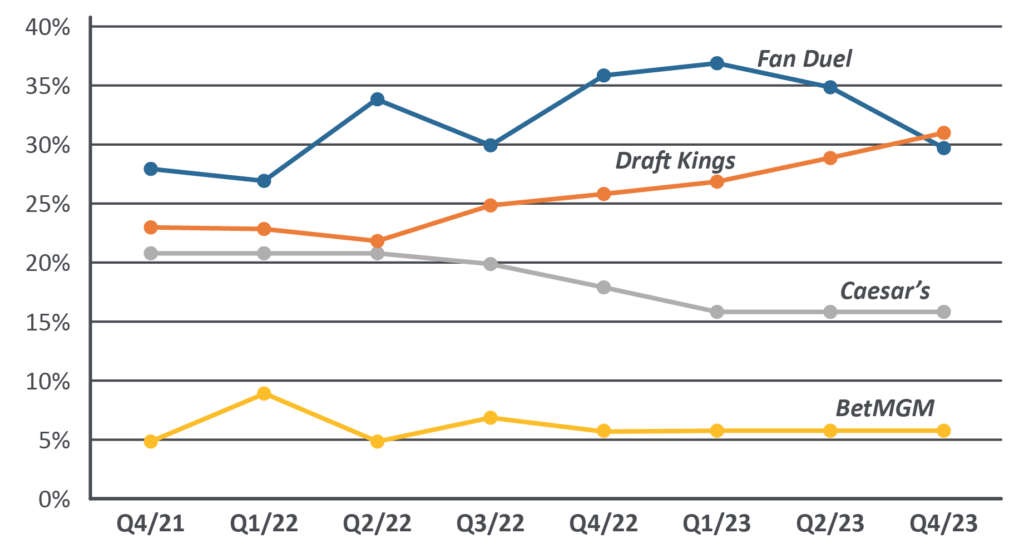

- Massive advertising spending by casinos and sportsbooks competing to claim an ever larger share of the lucrative sports gambling market.

U.S. SPORTS BETTING BEHAVIOR (1)

* 39.2 million placed sports bet in last 12 months

* 71% bet on sports at least once a week

* 20% bet on sports at least once a day

* Average bet between $20-$35, less than 2% more than $100