Preview table of contents and sample pages

CONTENTS

PREFACE

PART I: THE EVOLUTION OF SPORTS BUSINESS

Chapter 1: Defining the Business of Sports

PART II: FAN ENGAGEMENT

Chapter 2: Sports Events

Chapter 3: Sports Media

Chapter 4: Sports Entertainment

PART III: SPORTS PRODUCTS

Chapter 5: Sportswear Products

Chapter 6: Sports Equipment

Chapter 7: Sports Health

PART IV: SPORTS PARTICIPATION

Chapter 8: Sports Recreation

Chapter 9: Fitness & Exercise

Chapter 10: Outdoor Recreation

PART V: GLOBAL PERSPECTIVE

Chapter 11: Top 10 Sports Countries

Chapter 12: Top 50 Sports Cities

AUTHORS

ACKNOWLEDGEMENTS

GET THE ONLINE BOOK TODAY!

PREFACE

THE BUSINESS OF SPORTS

Fan Engagement, Sports Products & Sports Participation

This book is a comprehensive view of the scope, structure, and size of the $ 2.5 trillion sports business industry. The size is larger than most estimates of the sports industry, which limits fan engagement in sports events. We expand fan engagement to include sports media’s scope, structural components, and ever-growing sports entertainment. As necessary, we expand the scope to include sports products we buy and the money we pay to participate in sports and outdoor recreation.

We also include a global perspective with chapters devoted to the world’s top sports countries and sports cities. In these chapters, we bring in economic data to construct Sports Power Scores for countries and cities based on their capacity to generate sports industry revenues across the three domains of sports business – fan engagement, sports products, and sports participation.

The Business of Sports – Fan Engagement, Sports Products & Sports Participation is a must-have resource for students studying sports and industry professionals, journalists, advertisers, government agencies, and investors. And the book’s trove of sports industry revenue data and analysis is always available on any digital device.

The Evolution of Sports Business

The Business of Sports

The sports industry includes various events, products, and activities that engage people worldwide. More than any other industry, sports are global and serve our planet with a unifying spirit of competition, enjoyment, and health. Our goal in this book is to account for all these factors and explore how they shape the scope of the sports industry.

To understand the complexities of today’s global sports industry, let us consider where it came from and how it evolved. Sports and competition have been around if individuals can run faster, throw farther, or jump higher than their peers. Sports and competition are innate in our human structure and cultural condition.

The sports competition was first formalized in training soldiers to run, jump, fight, and ride horses and use poles, spears, and rocks in combat. The intense training inevitably

led to competition among soldiers. We can assume some observers even placed wagers

on the contests. Hence, one of the competitive sports’ first derivatives may have been

betting, and the early period also produced the first signs of sports as entertainment and

the importance of fan engagement.

Military competitions eventually led to the inaugural Olympic games in 776 BCE. The games were the first documented organized sports competition with athletes, events, spectators, and a venue. The events included boxing, discus, equestrian, long jump, javelin, running, and wrestling.

Beyond entertainment, what motivated the first Olympic competition? Many would be surprised to learn that the answer is war. The Olympic Truce is a tradition in ancient Greece, the year of the first games. The laying down of arms was announced before and enforced during the competition to ensure the host city-state was not attacked and athletes and spectators could travel safely to and from the games. From the beginning, sports and competition played a positive role in society, bringing together people traditionally at war.

Copyright 2023 The Business of Sports

1

The Business of Sports

The Evolution of Sports Business

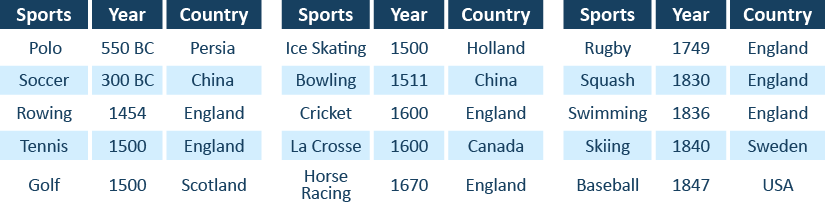

FIGURE I

Early Evolution of Sports: 776 BC to 1850

Note: Add: Badminton 100 China

FIGURE II

Continued Evolution of Sports Developed: 1850 to Today

Note: Add – Futsal 1930 Brazil, Pickleball 1965 USA

The Evolution of Sports

While the origins of sports are generally traced to 776 BCE, sports emerged between the first Olympics and 1850. The new sports and their rules evolved primarily in Europe, with some coming to Asia. Their development also led to the first cataloging of world records.

The era between 776 BCE and 1850 saw the creation of the sports shown in Figure I. Most of the time, sports venues consisted of fields, courts, and pools. Different from the giant arenas where the ancient Greeks and Romans showcased their skills, the new venues had limited room for spectators. The sparse seating offered the only form of sports fan engagement besides informal wagers among spectators.

The modern sports era began around 1850 and continues today. Shown in Figure II are many of the sports evolving during the period. In the early years, a dramatic shift occurred, with new

2

Copyright 2023 The Business of Sports

The Evolution of Sports Business

The Business of Sports

leagues, teams, and stadiums added for various sports like baseball, football, basketball, ice hockey, water sports, bicycle racing, and auto racing. By 1880, the United States became a driving influence in sports creation. As the new sports drew greater interest with the support of emerging media, fan engagement and venues show- casing the events also grew.

The Business of Sports

As sports venues grew and complexity, sponsors rushed to put their brands alongside events. Merchandise and broadcast media began to contribute a large part of the revenues produced by sporting events and the growing sports business.

Emerging technology drove the growing sports media and allowed events to reach audiences outside the venues in which they were played. The telegraph allowed scores to be shared, and radio broadcasts allowed fans to listen to entire events. Television, cable TV, and live internet streaming allowed more fans to watch and listen to events than they could attend. The new broadcast audiences quickly attracted new advertisers and sponsorships. The wide array of sports that could be viewed from almost any location also opened the market for sports betting and the evolution of sports entertainment products, including fantasy sports, video games, and sports bars.

Athletes participating in sports need footwear, apparel, and equipment. All sports require at least some specialized equipment and sportswear. Companies emerged to make balls, bats, sticks, rackets, golf clubs, poles, mitts, gloves, and skis. Over time, style and fashion became critical among sports products, as did health products like hydration beverages, energy bars, and nutritional aids. Today, athletes rely on their health and wellness to compete, and medicine and physical therapy innovations have become a large and growing part of the massive business of sports.

Sports have also come to include outdoor recreation, including camping, rafting, fishing, and hunting. The evolution of gymnasiums for boxers and weightlifters—and later health and fitness clubs—expanded sports participation into the exercise arena. Boating and recreational vehicles drew even more individuals to outdoor recreation. Each new area of sports business has come to generate revenue worldwide. While the U.S. market is the largest for most sports, the rest still contributes more than 60% of worldwide revenue.

Chapter 1 of this book reviews past definitions of the sports industry and provides a comprehensive scope and structure to measure its size accurately. While we attempt to present an accurate picture of today’s global sports industry, one thing is sure: The industry will continue to change as it evolves with new sports, ways to view and enjoy sports, and products. and ways to participate in sports and outdoor recreation. And as worldwide prosperity grows, more of the world’s population will become part of the sports industry. We can also expect the industry will continue to play a growing role in worldwide health and wellness.

Copyright 2023 The Business of Sports

3

GET THE ONLINE BOOK TODAY!

Defining The Business of Sports

The Business of Sports

Scope, Structure & Size

Sports are global, and their influence goes beyond the playing field and sports arena. Around the globe, sports teams perform before enthusiastic fans at modern venues, and even larger audiences watch on TV or stream online. An increasing number of interested viewers now wager considerable sums on sports outcomes.

Millions of people of every race, ethnicity, and nationality also spend considerable money on sports products, including sportswear, equipment, and health products and service. While many play sports professionally, many spend countless hours participating in their favorite sports and recreation activities, generating billions in sports business revenues through fees, memberships, and licenses. The business of sports is more than the sports we follow in person, in the media, and with sports entertainment. The sports business includes sports products and participation, both of which are derivatives of sports and fan engagement.

The purpose of Chapter 1 is to examine a broad-scope definition of sports business and develop a structure that allows us to (1) better understand the breadth and depth of the sports business, and (2) provide a structure to understand better how different aspects of the sports business fit into the business of sports and structure from which we can accurately measure these elements and the entire size of the sports business. Figure 1.1 summarizes our approach to defining the business of sports.

FIGURE 1.1

Defining the Business of Sports

Copyright 2023 The Business of Sports

5

The Business of Sports

Defining The Business of Sports

Definitions of Sports Business

Before we jump into what we propose, it is important to review what is currently used to define the business of sports. Previous efforts to define and measure the sports business industry must overcome one major challenge: The U.S. government needs to recognize sports as a separate or standalone industry. As a result, it is impossible to find a single definition of what constitutes the industry or a consolidated figure representing its economic magnitude. Sports-related activity segments are scattered, without apparent rationale, across several categories of the North American Industry Classification System (NAICS). Sports and Athletic Goods Manufacturing is classified under NAICS code 339920, Spectator Sports is under 711219, and yet another category, Sports Teams and Clubs is under 711211.

It is possible to combine figures across categories to estimate the size of the U.S. sports industry. Using Department of Commerce guidelines, researchers Milano and Chelladurai create a Gross Domestic Sports Product (GDSP) metric by aggregating “the market value of the nation’s output of sports-related goods and services” (1). Their analysis produces three GDSP estimates for 2005, ranging from a conservative $168.5 billion to $207.5 billion, an estimated $300 billion in 2023 accounting for inflation. The researchers’ use of the U.S. government classification system captured more relevant sports content than any other industry estimates. The only estimate includes entertainment and recreation activities like sports betting, fantasy sports, and sports medicine.

Plunkett Research (2) provides the most complete descriptive overview of the global sports market. It is one of many commercial firms offering sports industry market forecasts, trend analyses, and financial performance data. Plunkett’s Sports & Recreation Industry Almanac offers currency and a global perspective. The almanac provides an extensive description of the sports industry’s many products and services and the trends—particularly technology-related—influencing its growth. The industry overview recognizes the emerging prominence of esports, fantasy sports, and sports betting and estimates the size of the U.S. and global sports and recreation markets. The 2020 Almanac estimates that 2018 U.S. sports market revenues reached $540 billion. The rest of the world’s spending amounted to $ 905 billion in 2019, bringing the global sports market’s estimated aggregate value to $1.45 trillion and $1.43 in 2020 (3) The Plunkett Research estimate is far greater than most commercial research studies.

Two other frequently referenced publications offer sports industry market size forecasts, trend analyses, and financial performance statistics. ResearchAndMarkets.com released a report in 2019 (4) estimating the value of the 2018 global sports market at $488.5 billion and projected growth to $614 billion in 2022. The growth figure has been widely referenced in news and journal reports around the globe.

In The Sporting Goods Industry, Richard Lipsey offers a detailed analysis of the market’s major segments (5). While Lipsey focuses primarily on consumer products and sports participants’ equipment, he provides a thoughtful overview of the cultural and technological dynamics influencing the industry’s shape and structure. His chapter on the U.S. industry’s size provides a template for capturing participation and spending data for various sports activities and product categories. While the data cited in Lipsey’s 2006 publication is no longer current, his approach to identifying and assembling data is a useful resource.

6

Copyright 2023 The Business of Sports

Defining The Business of Sports

The Business of Sports

FIGURE 1.2

Missing Elements in Existing Sports Business Definitions

A few things should jump out at you from this review of existing definitions of the business of sports.

Of these four definitions, two are over 15 years old, and one is limited to the United States. Sports products such as sportswear and equipment in only one definition. Participation levels and spending in sports, fitness programs, and outdoor recreation is not included in these definitions.

We created Figure 1.2 to list several areas of sports business that should be considered in existing definitions. Our view is that the sports business includes all aspects of sports viewing, the sports products we wear, and the money we spend on memberships, use fees, and licenses to participate in sports. These missing elements are not just important; they interact with each other. For example, professional sports events sell tickets and create media viewers but also sell sports products like sports shoes, apparel, and equipment and influence money consumers spend on sports participation.

The biggest omission is outdoor recreation. The sports business should include camping, hiking, bicycling, winter sports, water sports, and sports-related vehicles such as golf carts, jet skis, snowmobiles, camper vans, and recreational vehicles.

Scope – What Should Be Included?

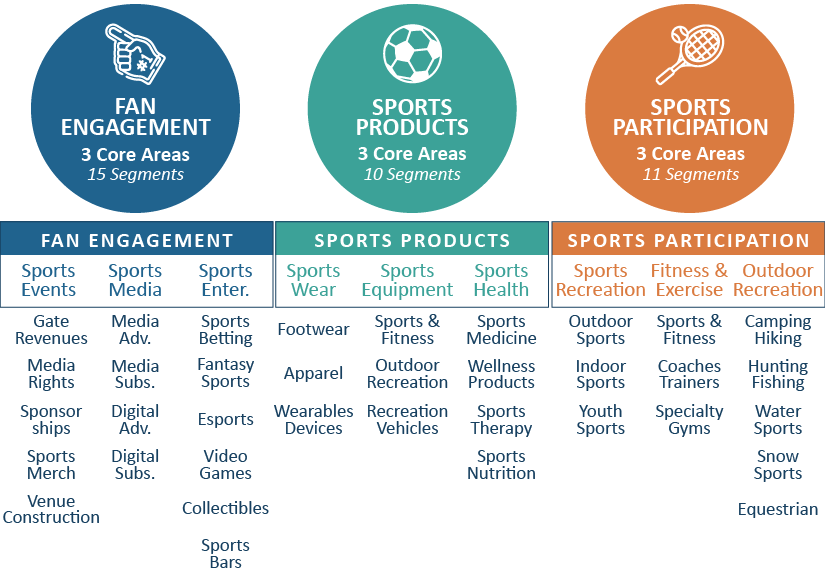

We propose a very broad-scope definition of the business of sports. It should be global and include all sports and countries while paying close attention to the United States as it is the largest country market for sports business. In addition, we propose a definition of sports business that includes all aspects of sports, sports products, and sports participation would significantly broaden the scope of the sports business and its revenues. A board-scope definition is built around the three sports business domains defined below and shown in Figure 1.3.

- Fan Engagement: Revenues generated by sports fans for attending sports events, viewing them via sports media, and extending their engagement to sports entertainment that includes sports betting, fantasy sports, e-sports, sports video games, and sports memorabilia.

Copyright 2023 The Business of Sports

7

The Business of Sports

Defining The Business of Sports

FIGURE 1.3

Best-Howard Sports Business Model & Three Domains of Sports Business

- Sports Products: Revenues are produced by purchasing sportswear, equipment, and health products and services.

- Sports Participation: Revenues created from fees, licenses, and memberships that occur with sports recreation, fitness and exercise, and outdoor recreation.

The Best-Howard Sports Business Model fully captures the full scope of the sports business industry. This sports business model includes three core domains: Fan Engagement, Sport Products, and Sports Participation. Each sports business domain is uniquely different and represents a different domain of sports business revenues. This greatly expands the scope of the sports business and increases the complexity of its underlying structure. In addition, this broad-scope definition of sports business will increase global revenues well beyond the highest estimate of $1.5 trillion.

Structure – How to Organize?

The three major domains of sports business are concepts that cannot be measured with a single number. They are constructs that result from a structure of elements that define each of these sports business domains.

DOMAIN I: FAN ENGAGEMENT

Experiencing. Fan Engagement includes all sports fan-related experiences, including attending sporting events, watching them on a preferred media platform, and participating in sports entertainment like fantasy sports, video games, and wagering. All are ways in which fans engage with their preferred sports. Fan Engagement includes the core areas of Sports Events, Sports Media, and Sports Entertainment. Each core area is subdivided into four to six segments representing distinctive sources of sports business revenue.

8

Copyright 2023 The Business of Sports

GET THE ONLINE BOOK TODAY!

Defining The Business of Sports

The Business of Sports

Sports Events are the wellspring of engagement. Without league games, matches, tournaments, and road races, fans would have nothing to watch, stream and bet on. Much of the Best-Howard Model depends on fan-engaging events. And the event producers—from professional sports leagues to the Boston Marathon—depend on revenues produced from ticket sales, registration fees, television broadcast rights, corporate sponsorships, and licensed merchandise.

The Fan Engagement domain is an important sports business domain encompassing core areas of sports events, sports media, and sports entertainment. Sports event revenues, however, are derived from five sports business segments – gate revenues, media rights, sponsorships, sports merchandise, and venue construction, as illustrated in Figure 1.7. A sports team like the Dallas Cowboys or Manchester United would have 2023 revenues from these five segments, a part of worldwide segment revenues shown in Figure 1.7. These five segments produce worldwide revenues for sports events in 2023. Chapter 2 will examine these segments in detail for the United States and globally.

The growing worldwide, interdependent fan engagement ecosystem includes media companies televising and streaming sporting events and corporate partners aligning their brands with highly visible sports properties. The Sports Media core area and its prominent role in engaging sports fans represent a significant opportunity as media outlets increasingly target digital devices and streaming platforms. All the segments included in the core area of Sports Entertainment, such as wagering and fantasy sports, are also integral to the Fan Engagement ecosystem and highly dependent on a robust sports events calendar.

The Sports Entertainment core includes several of the world’s fastest-growing activity segments—sports betting, esports, and fantasy sports. Increased worldwide internet access and smartphone use, coupled with many new and attractive mobile applications, allow hundreds of millions of people around the globe to engage in sports in ways not possible a decade ago.

DOMAIN II: SPORTS PRODUCTS

The Sports Products domain includes Sportswear, Sports Equipment, and Sports Health, covering sports medicine, nutrition, and drinks. The domain includes all products athletes and consumers use in sports, exercise, recreation, and everyday living.

Sports Equipment includes the specialized gear used across three major areas of sports and recreation—mainstream recreational sports like golf and tennis, gym and fitness activities from yoga to CrossFit, and outdoor pursuits like hunting, fishing, and backpacking. The closely related

Copyright 2023 The Business of Sports

9

The Business of Sports

Defining The Business of Sports

recreational vehicles segment recognizes the growing popularity of campervans, caravans, camper trailers, truck campers and all-terrain vehicles.

The Sportswear core area focuses on specialized footwear and clothing designed for engaging in sports and recreation activities, as well as wearable health monitors and smartwatches. The Best-Howard Model also highlights the growing trend of sportswear used in everyday, non-sports contexts—from the workplace to leisure activities—leading to a new fashion category, Athleisure.

The third core area in the Sports Products domain is Sports Health. This area of sports products is often overlooked but rapidly growing. Global spending on sports medicine, sports therapy, wellness, and nutrition products collectively surpassed $130 billion worldwide in 2023.

DOMAIN III: SPORTS PARTICIPATION

Sports Participation includes three core areas: Sports Recreation, Fitness & Exercise, and Outdoor Recreation. An abundance of credible data shows the number of people in the United States participating in sports and recreation activities in each core area.

Credible annual spending data are provided for several sports and recreation activities by U.S. government organizations. The U.S. Fish and Wildlife Service, U.S. Forest Service, and National Park Service collect annual data on user, licensing, and permit fees related to hunting, fishing, camping, and boating. In addition, sports industry trade associations (e.g., for fitness and health clubs, golf, boating, and downhill skiing) report annual revenues from membership fees, greens fees, ski passes, moorage fees, etc.

10

Copyright 2023 The Business of Sports

Defining The Business of Sports

The Business of Sports

FIGURE 1.4

Sports Business – Domains & Core Areas

The Best-Howard Model draws on the available data to complement its participation trends analysis in 12 Sports Participation segments. Of special consideration are the challenges facing youth sports organizations, such as declining participation, rising costs, and their role in combating the growing obesity crisis.

We propose in Figure 1.4 three core areas that help define and measure each domain of our sports business model. Each core area further defines each sports business domain and offers a measurable area of sports business. For example, fan engagement is further defined and measured based on three core areas of fan engagement – sports events, sports media, and sports entertainment.

Each of the nine core areas has sports business segments that further define that core area. Figure 1.5 provides a more comprehensive view of the sports business segments, further defining each core area and sports business domain. Only three segments were created for some core areas to define that core area further. This is the case for three of the nine core areas. Others, like sports entertainment, have six measurable segments of sports business, while two others have five segments.

However, the structure is more complex and can be extended to segments that further define each of the nine core areas shown in Figure 1.6. For example, the core area of sports events is further defined and measured with the five core area segments shown in Figure 1.6. As shown, fan engagement comprises sports events, sports media, and sports entertainment. And sports events are further defined and measured based on five segments of sports events revenues – gate revenues, media rights, sponsorships, merchandise, and venue construction. As shown, each of these sports event segments generates global, country, and city revenues that, when summed, are the sports event revenues.

The Best-Howard Model uses nine core areas under its three primary domains to capture the structure of the business of sports: Sports Events, Sports Media, Sports Entertainment, Sportswear, Sports Equipment, Sports Health, Sports Recreation, Fitness & Exercise, and Outdoor Recreation. Each major sports business model addresses the core areas to different extents. In Figure 1.7, the core areas are organized under the Best-Howard Model’s three domains. Comparing the four current definitions of sports business about breadth and depth, the number of stars in each column shows the extent to which each core area is addressed. As shown, the Best-Howard model has the most comprehensive scope and structure.

Copyright 2023 The Business of Sports

11

The Business of Sports

Defining The Business of Sports

FIGURE 1.5

Sports Business Segments

To some degree, the Best-Howard Model consolidates the available market studies’ common elements. At the same time, each of the existing models offers good depth in one or two sports business domains, none cover the three domains and the core areas of each. The Milano and Chelladurai paper is a foundation for the Best-Howard Model’s development, and the Plunkett Research Group offers the most comprehensive coverage of sports business core areas.

FIGURE 1.6

Sports Events - Core Area & Segments (billions)