Preview table of contents and sample page

About this Handbook

The Hidden Engine Behind the Business of Sports

What if the real MVP of the sports industry isn’t an athlete—but the fans?

From new sports entertainment districts to media mega-deals, sports fans fuel a business worth hundreds of billions. Every ticket, stream, bet, jersey, and fantasy league entry adds up. This isn’t just passion—it’s economic power. Fan Engagement is the driving force behind the $2.79 trillion global sports industry.

This new industry report takes a behind-the-scenes look at how fan engagement drives the sports economy across three pillars.

Sports Events: Behind every roaring crowd is a finely tuned revenue machine. Global sports events generated over $240 billion in 2024 alone. This report breaks down the five key revenue streams that turn every whistle and walk-on into profit: gate revenues, media rights, sponsorships, merchandise sales and venue construction.

Sports Entertainment: How fans extend their engagement in sports experiences that encompass: sports betting, fantasy sports, video games, esports, sports collectibles and sports-themed bars. In 2024, spending on these six core areas of sports entertainment totaled nearly $380 billion.

Sports Media: Sport media is no longer just the voice calling the play-by-play. It’s multiple platforms where fandom lives 24/7. From traditional broadcasts to on-demand streaming and interactive digital content, sports media has transformed how – and how often – fans connect with their favorite teams, athletes, events with total revenues of $166.5 billion in 2024.

If you work in sports – or want to understand what’s next—this is essential reading. This full report breaks down revenue flows, recovery trends, and growth forecasts that are already reshaping the global market.

Sports Industry Report

Contents

CONTENTS

Sample Page 1

Fan Engagement

Where would the sports industry be without fans?

Fan engagement is the driving force of the sports industry with 2024 global revenues of $789.9 billion. This resulted entirely from fans who paid to go to sports events, watched media broadcasts, bought team and player merchandise, bet on events, played fantasy sports, and purchased sports video games.

Fans’ enthusiasm and loyalty to the teams and players they support are at the heart of the sports industry. Indeed, the term “fan” is derived from the word “fanatic,” a person displaying excessive enthusiasm and intense devotion. Fans often identify with the teams they support (Figure I), and after “big wins,” avid fans often wear their team’s apparel, buy more team merchandise, and use phrases like “we won” when describing the victory. Following disappointing losses, fans tend to distance themselves from their team by not wearing apparel and using language like “they lost,” omitting reference to the team by name.

FIGURE I

Fan Passion Provides Pride, Belonging & Self-Esteem

Copyright 2025 The Business of Sports

01

Sample Page 5

The Heart of Sports Business

The heart of the sports industry is the hundreds of thousands of organized games, matches, and races that occur around the globe each year. Fueled by competition, drama, and pageantry, passionate fans in the hundreds of millions attend and watch sports events played in ever more lavish and expensive stadiums and arenas.

Gate receipts are just one component of the revenues derived from sports events. Money spent by fans to park and to purchase food and beverages adds to event revenue, as does the sale of media rights. Media companies pay teams and leagues to broadcast their events on TV, radio, or the Internet. (Figure 1.1).

FIGURE 1.1

Sports Events Segments

Sponsorships – money a corporation pays to a team to advertise and promote its brand at events – are another important source of sports event revenue. Sponsorships can range from placing brand names or logos on player jerseys to investing millions in placing a corporation’s name on a stadium or arena.

The sale of team or league merchandise at events, in retail stores, or online also provides revenue for teams, leagues, and sometimes athletes.

Finally, the billions invested in constructing a new generation of “state of the art” stadiums and arenas full of expensive luxury seating options and amenities has produced abundant income streams for team owners and event operators.

Copyright 2025 The Business of Sports

05

Sample Page 41

Sports Entertainment

Extending Sports Enjoyment

The Best-Howard Model (Figure 2.1) examines how fans engage the sports industry through mostly virtual experiences through its Sports Entertainment core area. Betting online, participating in or viewing esports competitions, joining a fantasy sports league, and playing sports video games with friends can all be accomplished on various electronic devices, allowing easy and around-the-clock fulfillment.

Sports fans worldwide spent $36.6 billion in 2024 on sports memorabilia, from trading cards to game-used items like balls and jerseys. The value of cards and iconic sports merchandise has appreciated so rapidly over the past decade that some collectors view sports memorabilia as investment-grade assets. Spurred by the rapid expansion of online platforms, the sports trading market is projected to reach over 100 million collectors globally within the next three to five years.

The Best-Howard Model also recognizes an increasingly popular sports engagement dimension, and social dining experiences in sports-themed environments. Restaurant Business magazine recently recognized sports bars as a standalone industry category. In 2024, total sports bar sales reached $15.4 billion in the United States alone.

This chapter is devoted to providing an in-depth examination of the performance of each of the six segments, detailing spending trends over the past decade and projections for future growth.

Sports Entertainment Segments

Copyright 2025 The Business of Sports

41

Sample Page 91

Sports Media

Extending Fan Engagement

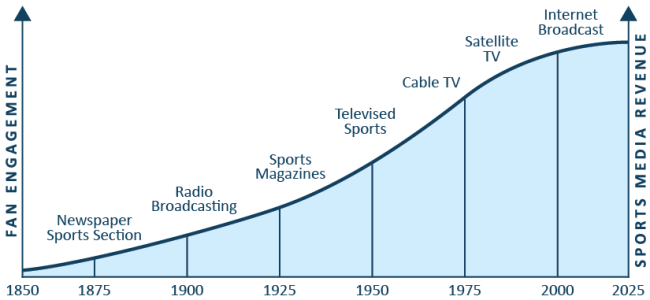

Many sports fans around the globe will never attend a live event to watch their favorite teams or players in person. For them, the only way to experience a sports event is by watching it on a television, computer or mobile device screen or listening to it on the radio. In many countries, traditional television is the overwhelming viewing option for watching live sports. A global survey of fan viewing behavior found two-thirds or more of respondents in Brazil (78%), Argentina (75%) France (74%), Indonesia (73%), Spain (68%), Italy (67%), China (66%) and India (66%) watched their favorite teams play on television (1). While TV remains the predominant viewing option in many countries, the rapid growth of online options allows an increasing share of fans to follow their favorite teams on mobile devices. A recent study in the United Kingdom found 59% of British sports fans prefer watching live sports exclusively on streaming platforms.

FIGURE 3.1

Evolution of Sports Media and Fan Engagement

Copyright 2025 The Business of Sports

91