Preview table of contents and sample page

About This Report

Over the past year, many sports industry professionals and academic instructors have requested specific chapters from our book, The Business of Sports. The 450 page, 12 chapter book is available online ($79.50) and in print ($99.50) at www.globalsportsinsights.com. In response to those interested in selected topics (e.g., How Big is the Sports Industry? Youth Sports, Sports Entertainment, Sports Betting), we are now offering a menu of more focused content, very reasonably priced.

Below is a brief summary of the essential content of our Sports Industry Report on Sports Events. It is the result of an intensive search of the most current, relevant and credible data sources on this topic. Woven into the analysis are a number or videos and exhibits highlighting new trends in sport facility operation and development.

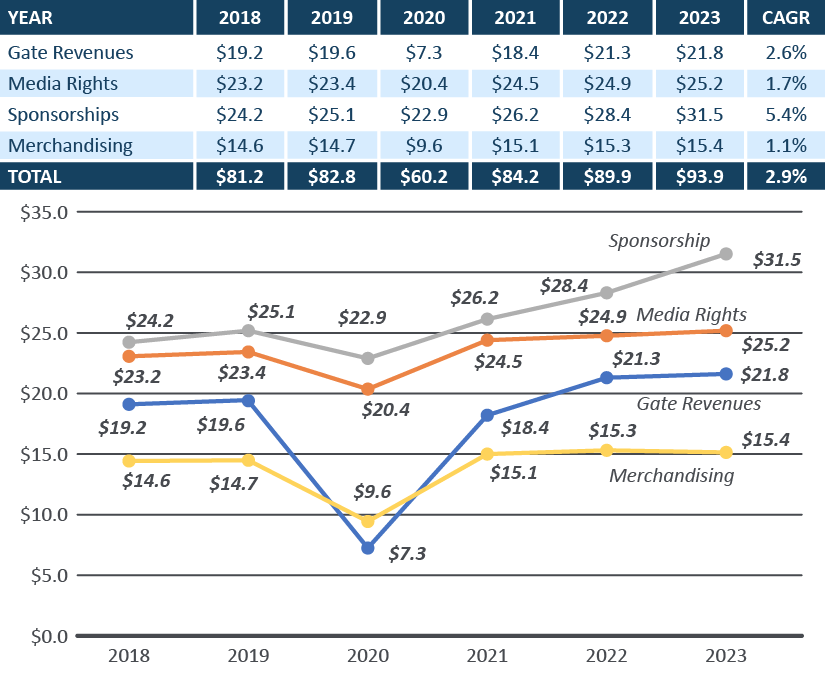

This report focuses on the four core revenue-generating sources of live sporting events: Gate Revenues, Media Rights, Sponsorships and Merchandise. In 2023, these event revenue sources generated $208 billion worldwide. North American sports events contributed nearly half of the global total, $94 billion.

The report analyzes the relative contribution of each primary revenue source to overall event spending over a 6-year period. This analysis includes an examination of the impact of COVID-19 on event revenues at the height of the pandemic and rates of recovery for each source through 2023.

Over the past decade, $155 billion has been spent globally building/renovating sports facilities (nearly $65 billion in U.S. and Canada). The report catalogs the number and amount invested annually on new facility construction globally and in North America. Analysis focuses on the new generation of facilities loaded with features to enhance the fan experience, and the emergence of a new wave of stadiums and arenas serving as the centerpiece of Sports Entertainment Destinations, such as SoFi Stadium in Los Angeles.

For instructors planning to use this report as a required reading, we provide extensive Instructor Support materials, including: Slides of key report graphics, Discussion Questions, and a Test Bank including multiple choice, short answer and essay questions.

We hope you find our report of great value and thank you for your purchase.

Sports Industry Report

Contents

CONTENTS

Sample Page 1

The Heart of Sports Business

The heart of the sports industry is the hundreds of thousands of organized games, matches, and races that occur around the globe each year. Fueled by competition, drama, and pageantry, passionate fans in the hundreds of millions attend and watch sports events played in ever more lavish and expensive stadiums and arenas.

Gate receipts are just one component of the revenues derived from sports events. Money spent by fans to park and to purchase food and beverages adds to event revenue, as does the sale of media rights. Media companies pay teams and leagues to broadcast their events on TV, radio, or the Internet. (Figure 1.1).

FIGURE 1.1

Sports Events Segments

Sponsorships – money a corporation pays to a team to advertise and promote its brand at events – are another important source of sports event revenue. Sponsorships can range from placing brand names or logos on player jerseys to investing millions in placing a corporation’s name on a stadium or arena.

The sale of team or league merchandise at events, in retail stores, or online also provides revenue for teams, leagues, and sometimes athletes.

Finally, the billions invested in constructing a new generation of “state of the art” stadiums

and arenas full of expensive luxury seating options and amenities has produced abundant income streams for team owners and event operators.

Copyright 2025 The Business of Sports

01

Sample Page 6

Sports Events

Figure 1.5 examines the performance of each event revenue source from a global perspective (5). Overall, event revenues worldwide reached an all-time high of $208.4 billion in 2023, exceeding pre-COVID levels by a significant margin. The substantial increase in corporate sponsorship support has been a key factor in global growth. Sponsorship spending jumped nearly $7 billion in 2023, accounting for 70% of the $9.7 billion total event revenue increase that year. Notably, gate revenues have yet to recover fully. This is due largely to the lingering effects of COVID-19 in many Asian and European countries. While showing modest gains in 2023 to $40.8 billion, worldwide gate revenues remain nearly $9 billion below the pre-pandemic peak of $49.4 billion in 2019.

FIGURE 1.6

North America Sports Events Revenues (billions)

Figure 1.6 focuses on the North American events market (6). The first thing to note is the region’s enormous share of global event revenue. In 2023, the United States and Canada generated $93.9 billion in revenues, nearly half of the worldwide event total. An examination of annual figures reveals that North America recovered more rapidly from the height of the global pandemic than the rest of the world. The U.S. and Canada’s cumulative annual growth rate (CAGR) from 2020 to 2023 was a robust 16 percent. The global recovery rate at a healthy rate of

06

Copyright 2025 The Business of Sports

Sample Page 28

Sports Events

FIGURE 1.27

SoFi Stadium, the World’s Most Expensive Sports Facility

Both Allegiant Stadium in Las Vegas, Nevada, and Capital One Arena in Washington, D.C., include sportsbooks, areas in which ticket holders can wager on competitions. Gamblers can place bets on Major League Baseball, UFC bouts, NASCAR auto racing, and golf tournaments.

28

Copyright 2025 The Business of Sports