Preview table of contents and sample page

About This Report

The following summary of our Sports Industry Report on Sports Betting is the result of an intensive search of the most current, relevant and credible data sources on this topic. Woven into the analysis are a number of videos and exhibits highlighting the growth and impact of sports gambling around the globe and its positive and negative impacts on the sports industry.

Countries in every region of the world offer legal, government-regulated sports betting. This report examines the significant variation in the types of sports betting allowed from one country or region to another. In regions such as Asia, where sports gambling is illegal or severely restricted in many countries, millions wager on off-shore, unregulated sports betting sites.

In 2023, global sports annual revenues reported by IBIS World on legal betting sites totaled $261 billion in U.S. dollars. This amount was down from the all-time pre-COVID epidemic high of $281 billion in 2018. At the same time that global sports betting is slowly recovering from the height of the pandemic in 2020 and 2021, sports gambling has become the fastest growing segment of the sports industry in the U.S. The legalization of sports betting by the U.S. Supreme Court in 2018 opened the proverbial floodgates. Over the past 5 years, Americans have spent $317 billion legally wagering on a wide range of state-regulated on-line betting services (sportsbooks) and in-person casinos or betting parlors. By 2023, sports gambling revenues reached $124.5 billion, accounting for nearly 48% of the world’s total.

Our report examines how major sports leagues in the U.S. have embraced sports betting as an abundant new revenue stream and as an opportunity to deepen fan engagement. Many teams have opened sportsbooks in their stadiums and arenas to integrate live betting into the sports venue experience. A recent survey of sports bettors found:

• 39.3 million placed a sports bet in the last 12 months

• 71% bet on sports at least once a week

• 20% bet on sports at least once a day

• Average bet is between $20-$35, less than 2% bet over $100

The report reveals the rapidly growing Sports Gambling Ecosystem in which major media companies like Disney-ESPN are competing for a share of the sports betting market with dominant sportsbooks like FanDuel and DraftKings. In 2023, the thousands of sportsbooks in casinos, sports parlors and on-line betting services spent $35 billion advertising on sports TV and digital platforms.

Finally, the report investigates the dark side of sports gambling in which millions, primarily young men, in the U.S. and globally are struggling with gambling addiction. While many countries with more mature sports betting systems have imposed restrictions on sports gambling advertising, in the U.S., the many stakeholders of sports betting continue to spend billions of dollars promoting gambling on TV and in nearly every professional sports venue.

Sports Industry Report

Contents

CONTENTS

Sample Page 1

Sports Betting

“In time, the expansion of legal wagering will drive fan engagement and in turn, viewership and will become a growth category for sports advertising at both the national and local levels.”

– Eric Shanks, Head of Fox Sports.

The Best-Howard Model relies on several reputable sources, including IBISWorld, American Gambling Association and Statista, to estimate a credible sports wagering revenue.

However, each measures and reports annual sports betting revenues differently. Statista and the American Gambling Association report the amount wagered on sports annually, known as the handle (1). IBISWorld reports net total sports betting revenues, in which the analyst deducts the amount kept by gambling operators (e.g., casinos and online betting services) after paying winners (2). The result, known as the hold, amounts to about 8% of total wagered revenues (3).

In Figure 2.3, the IBISWorld net annual revenue figures were converted into annual gross estimates, including the standard 8% hold. For the U.S., the actual handle or total amount wagered annually by sports bettors was used (4). In 2023, the global handle totaled $261.4 billion. Sports gambling in the U.S. in 2023 increased to an estimated $124.5 billion, accounting for nearly 48% of the world’s total.

Copyright 2025 The Business of Sports

1

Sample Page 4

Sports Betting

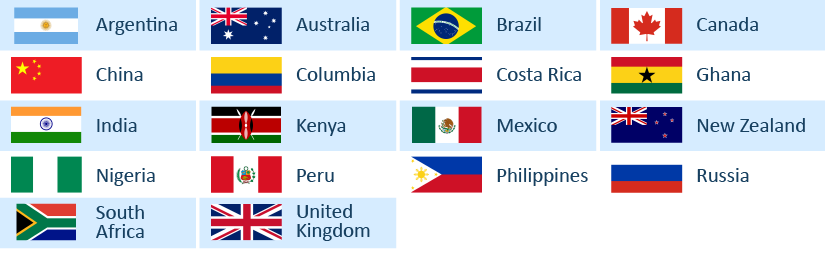

FIGURE 1.2

Notable Countries Offering Legal Sports Betting

In-depth information on the sports betting format allowed in each country

The United Kingdom has the most well-established, robust legal sports betting industry of any nation globally. Legal gambling has existed in Great Britain since 1960. The industry encompasses all sports, has over 6,000 retail betting outlets, and offers many sophisticated online gambling platforms. Most major U.K. soccer clubs have established partnerships with gambling firms like William Hill, which operate onsite betting parlors and dispatch roaming cashiers throughout stadiums during matches. The most currently published figure on the U.K. sports betting handle is the Gross Gambling Yield from April 2022 to March 2023, totaling $19.2 billion (5). The total includes all forms of gambling (e.g., lotteries, bingo, in-person casinos, online/remote betting).

Several African countries, including Ghana, Nigeria, and South Africa, permit gambling on almost all sports at betting parlors and online. Nigeria bans sports betting ads on television and radio, while South Africa requires every broadcast advertisement to be accompanied by a service message offering help for gambling addiction. Analysts estimate that $4.2 billion is wagered annually on sports in and billions in South Africa (7).

Sports betting has been restricted in South America’s two largest countries, Argentina and Brazil. In Argentina, sports gambling is legal but severely limited. In Argentina, wagering is limited to one sport. horse racing in one city, Buenos Aires. Brazil legalized sports betting in 2018, but unlike the U.S., its growth has been slowed due to legal challenges by several states over tax and distribution issues. Columbia and Peru have well-established sports betting. While sports wagering in Columbia has a troubled past, recent government intervention has strengthened the integrity of the country’s sports betting platforms. Peru was given high marks in a recent review of state-run sports betting programs around the globe, concluding that Peru’s well-run and regulated gambling programs were ‘thriving”. In contrast to Peru’s robust sports betting market, several South American countries have not legalized sports betting (e.g., Bolivia) or restricted sports wagering to land-based casinos or state-run lotteries (e.g., Chile, Venezuela).

4

Copyright 2025 The Business of Sports

Sample Page 8

Sports Betting

FIGURE 1.4

Capital One Arena’s Full-Service Sportsbook

Shortly after opening Caesars Sportsbook, several team owners followed Ted Leonsis’ lead. As shown in Figure 1.5, 15 teams in the United States have established sportsbooks in or adjacent to their venues (26). Integrating live betting into the stadium experience has proven to be a win-win proposition for owners and teams. Easily accessible betting surrounded by attractive amenities (food, beverage and entertainment) enhances the fan experience while providing team owners with a profitable new revenue stream.

FIGURE 1.5

Stadiums and Arenas in the U.S. with Sportsbooks

*Sportsbooks that are located not in but near stadiums. Note: On September 8, 2021 the New York Mets (MLB) announced a partnership with FuboTV to open a sports betting lounge at MetLIfe Stadium. Just six weeks later, the agreement was nullified when FuboTV filed for dissolution. Fubo Gaming, the division charged with operating the new sportsbook, ceased its operations on October 17, 2021.

Dedicated in-venue sports betting will likely become an increasingly prominent feature of sports venues as more states adopt legalized gambling. The opportunity to wager during a game will provide one more compelling reason for fans to attend live sporting events. In addition to spending time (and money) in the sportsbook entertainment lounge, fans can place bets online throughout the game from their seats. And, postgame, the sportsbook offers more betting opportunities and a chance for fans to either celebrate or drown their sorrows – all of which provide teams with a new and robust income stream.

8

Copyright 2025 The Business of Sports