The Ups and Downs of Europe’s Top Football Leagues

Before, During & After the COVID-19 Pandemic

By Dr. Dennis Howard and Dr. Roger Best

This analysis examines the financial performance of the “Big 5” European football (soccer) leagues from 2015 through 2022. This time frame allows tracking of a) how each league performed prior to the onset of the COVID-19 pandemic, from 2015 to 2019, b) the revenue loss suffered by each league during the height of the pandemic in 2019/2020 and 2020/21, and c) the initial rate of recovery for each league as COVID-19 restrictions waned or were removed.

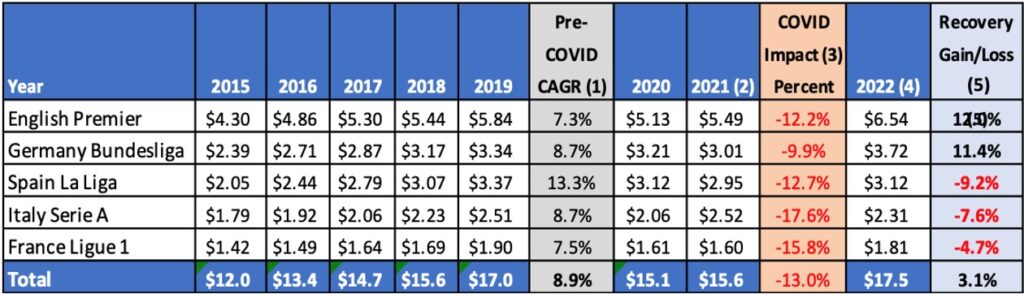

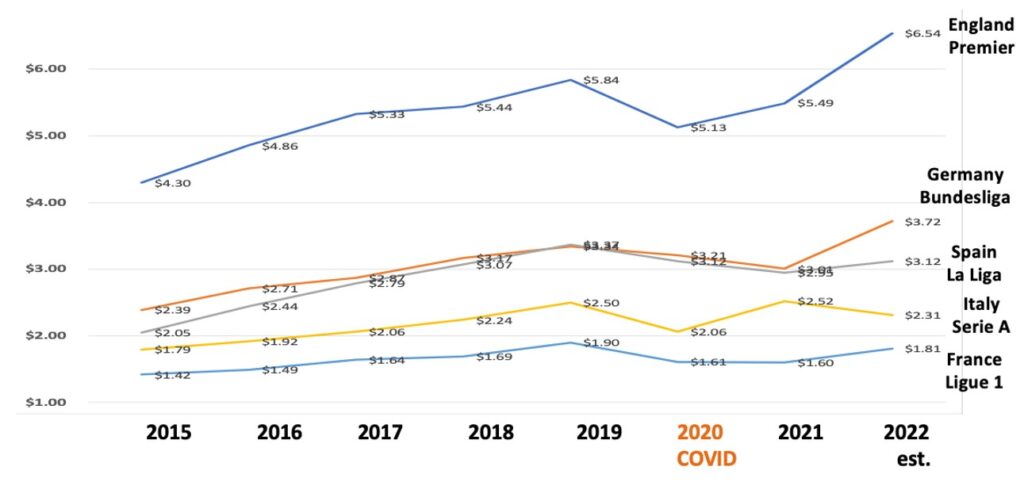

European Premier Leagues Revenues (U.S. billions) Pre- and Post-COVID 19

1 April 2020 was the first full month of the COVID pandemic in Europe. The Financial year for all European leagues overlaps

2 years from July 1 to June 30. Thus, revenues are reported for “operational” years 2014-2015 through 2021-2022.

3 Largest loss reported for a single operating year following 2018-19

4 Projected

5 Percentage gain or loss from 2019 pre-COVID league revenues compared to 2021-22 post-Covid-19 league revenues

Growth Prior to the Pandemic

The table and line graph of the pre-COVID performance of all 5 leagues shows steady annual revenue growth, ranging from the English Premier League’s 7.9% to La Liga’s robust CAGR of 13.3%. This sustained growth period resulted in total European major league revenues growing from $12.1 billion during the 2014/2015 financial year to an all-time high of nearly $17.0 billion in 2018/2019.

The rapid spread of the coronavirus across Europe in early 2020 led to all 5 premier leagues suspending play in March. Four of the leagues resumed play by June 2020. Only the French Ligue 1 shut down completely in April after the French government imposed a ban on all sporting events through September 1, 2020. Those leagues that returned to the pitch played a majority of their matches in “fanless” stadiums due to government-enforced attendance restrictions. The disruption caused by the COVID-19 pandemic resulted in the top European soccer leagues’ revenues contracting by 10.8% in 2019/20, with revenues falling from $16.96 billion in 2018/19 to $15.12 billion. The $1.84 billion loss was the first ever incurred by the “Big 5” leagues (1).

Euro Premier Leagues Lose $2.1 billion during Height of COVID-19 Disruptions

While revenues for the “Big 5” leagues improved modestly during the 2020/21 season, the COVID-19 infection had a serious impact as most teams were still playing matches in empty or reduced-capacity stadiums. Two leagues experienced their single largest revenue loss during the 2020/21 season. Both the German Bundesliga and Spanish La Liga reported losses of $330 million and $430 million, respectively, compared to their pre-COVID financial performance during the 2018-19 season. Accounting for the full financial impact of the pandemic must include the losses incurred over both the 2019/20 and 2020/21 financial reporting periods, which run from June 30 to July 31. The persistent infection had a disruptive effect over both measurement periods. The slight uptick in 2020-21 is partly due to a portion of broadcast rights from the 2019/20 season being recognized in the 2020/21 financial year.

The Euro leagues’ financial reporting overlaps two calendar years and there can be differences between leagues on which revenue sources are recognized each year. Therefore, determining a precise accounting of COVID-19 revenue losses across all 5 leagues is problematic. In estimating the full losses over the two reporting periods, this analysis accounts for the single largest annual loss incurred by a league in either 2019/20 or 2020/21(highlighted in Table). Simply using the $1.84 billion shortfall between 2018/19 and 2019/20 fails to recognize the significant losses reported by the Bundesliga ($330 million) and La Liga ($430 million) in 2020/21. Using the single largest loss in the year in which it was reported for each league – either 2019/20 or 2020/2021 – resulted in a total loss estimate of $2.21 billion. We recognize this as a fair representation of the COVID-19 pandemic’s full financial impact on Europe’s “Big five” through the height of the global pandemic.

While the revenue of all 5 leagues declined during the pandemic, the European continent’s wealthiest league, the English Premier League (EPL), suffered by far the greatest single-year loss of $710 million in 2019/20. The magnitude of the EPL’s coronavirus loss was nearly 2X to 3X larger than the losses of any of the other top European leagues. The Italian Serie A league experienced the relatively largest decline, losing close to 18%, or $440 million of the $2.5 billion revenues generated in 2018/2019. The French Ligue 1 followed close behind, losing nearly 16% of its pre-COVID-19 record high $1.9 billion revenues in 2018/2019.

Uneven Post-COVID-19 Recovery

Analysts have projected that the collective revenues produced by all 5 major European soccer leagues during the 2021/22 season will hit an all-time high of $17.5 billion (2). That projected growth figure would exceed the pre-COVID-19 record of $16.96 billion by more than $500 million. A closer examination of the expected financial performance of each league in 2021/22 shows a very mixed rate of recovery. All of the forecasted revenue boost is attributable to just two leagues, the English Premier League and the Bundesliga. The EPL is expected to generate $6.54 billion during the 2021/22 season, $1.4 billion more than its low of $5.1 billion in 2020, and $700 million more than its pre-pandemic high of $5.84 billion. The Bundesliga is also projected to fully recover the $330 million lost during the disrupted 2020/21 season. The German league is expected to achieve a new annual revenue record of $3.72 billion, a robust 11.4% increase in just one year. The EPL and Bundesliga are the only Big 5 leagues to have achieved a consistent record of operating profitability every year over the past two decades (1).

The quick and robust recovery of the English and German leagues contrasts significantly with Europe’s other major football associations. The 2021/22 revenues for all three of these leagues are projected to fall short of pre-COVID-19 levels, with shortfalls ranging from $260 million (La Liga) to $190 million (Serie A). While the recovery rates of each of these leagues are considerably slower, all are on a path to full recovery. As fans return to stadiums, match-day revenues have rebounded. Attendance levels across all leagues in the current 2022/23 season are encouraging. Ligue 1 is off to a record-setting pace, and current attendance at both the Serie A and La Liga league games is approaching pre-pandemic levels. Most importantly, new broadcast rights deals are projected to generate a record total of $18.1 billion across all 5 “Big 5” leagues. The English Premier League will be the greatest beneficiary of these new media rights revenues. In 2022, the EPL signed overseas broadcasting rights deals that, for the first time, eclipsed the value of its domestic UK rights. The international broadcast package worth $4.97 billion between 2002 and 2025 brings in slightly more than the domestic rights deal of $4.87 billion over the same time period (3). These new rights agreements have secured the English Premier League’s preeminent status into the foreseeable future. While the EPL will lead the way, Europe’s other top leagues have demonstrated remarkable resilience during a period of unprecedented turmoil and uncertainty. While their comeback from the depth of the pandemic may take longer, early indications from both fans and commercial interests (TV broadcasters and corporate sponsors) offer encouragement for the full recovery of all leagues over the next few years.

References

- Annual Review of Football Finance 2021 – Riding the Challenge, July 2021. Deloitte deloitte-uk-annual-review-of-football-finance-2021.pdf

- Annual Review of Football Finance 2022 – A New Dawn, August 2022. Deloitte Annual Review of Football Finance 2022 (deloitte.com)

- Premier League overseas TV rights will top domestic rights for the first time in next cycle, February 10, 2022. The Athletic.