Top North American Sports Leagues’ Remarkable COVID-19 Recovery

By Dr. Dennis Howard and Dr. Roger Best

Major professional sports leagues in North America have made a rapid and robust recovery from the depths of COVID-19 in 2020. The financial comeback has been so substantial that all four leagues, within a year of suffering staggering losses during the height of the pandemic, have generated record-breaking revenues, surpassing pre-pandemic levels.

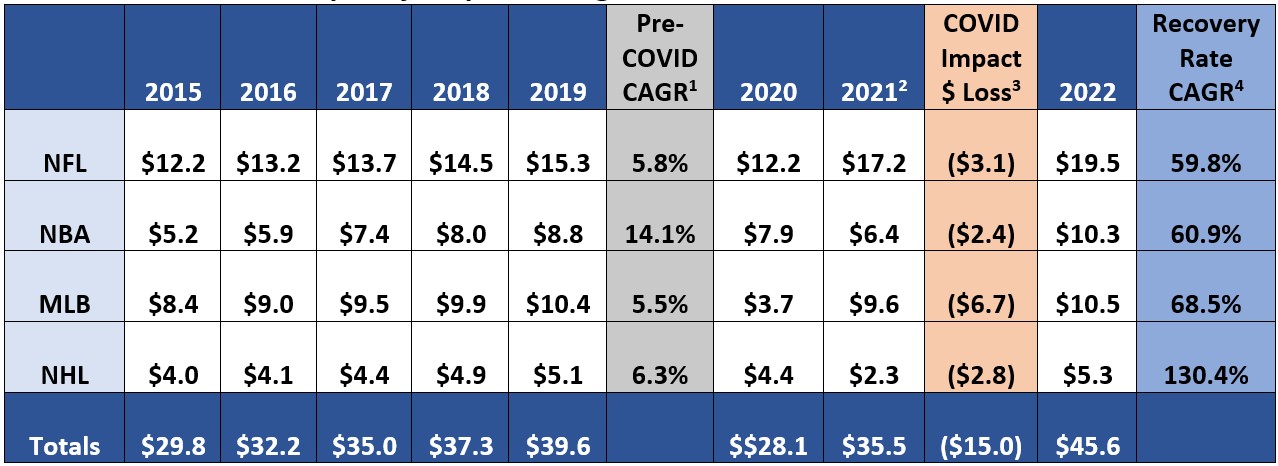

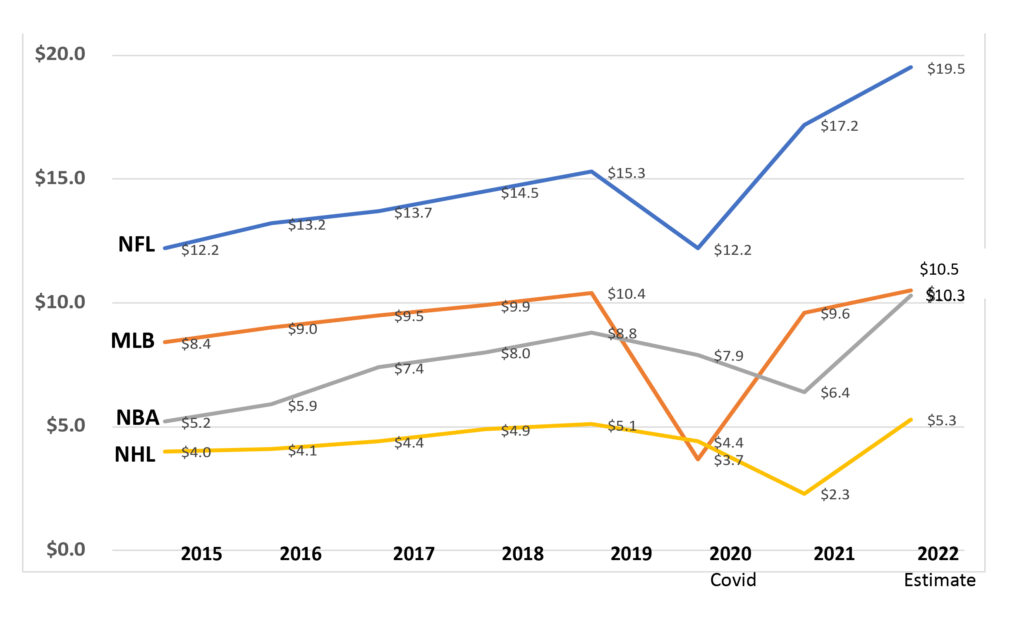

Annual Revenues of Top Major Sports Leagues in North America, Pre and Post COVID -19

Major League Baseball has made the most dramatic recovery. MLB revenues cratered during the 2020 season, plunging 64% from $10.4 billion the previous season to $3.7 billion. The pandemic resulted in the cancellation of two-thirds of MLB’s regular season games and a reduced number of playoff games with no fans in attendance. The League’s financial resurgence is largely due to 3 new television contracts which began at the start of the 2022 season. ESPN, Fox, and Turner Sports all signed extensions worth $12.4 billion. These lucrative agreements guarantee each MLB team more than $100 million annually through 2028 (1). New streaming deals with NBC Sports and Apple TV+ are expected to bring the MLB another $115 million annually. The MLB 2022 season ended on a strong note, with massive television markets in New York, Los Angeles, Houston, and Atlanta represented in the post-season playoffs.

The NBA also recovered dramatically during the 2021-2022 season, generating nearly $4 billion more in league revenues than the previous season. A huge contributing factor was the league’s return to a full 82-game regular seasons schedule after suffering through 2 consecutive COVID-restricted seasons. The NBA posted a record year in 2022, eclipsing $10 billion in revenue for the first time (2). Sponsorships brought in a record $1.46 billion. NBA League Pass subscriptions grew 30% as NBA playoff viewing audiences soared during the 2022 playoffs.

The league’s upward trajectory has analysts projecting a massive increase in media rights fees in the NBA’s upcoming negotiations with current and prospective broadcast partners. The league’s current agreements with ESPN and Turner Sports, worth a combined $24 billion, expire at the end of 2024-25. Analysts predict the new agreement could reach as much as $75 billion, ensuring the continued prosperity of the NBA through the end of the decade (3).

The National Football League is well on its way to achieving Commissioner Goodell’s goal of generating $25 billion by 2027. It is the most prosperous professional sports league in the world, dwarfing the other three major North American leagues by a magnitude ranging from 2X to 3X more in annual revenues. After losing $3 billion in 2020, the league quickly rebounded during the 2021 season and reported a record $17.2 billion in total league revenues. The continued robust growth of the NFL is primarily a function of the epic TV contracts that guarantee the league $113 billion through 2033.

The National Hockey League was also a beneficiary of increased media rights deals with ESPN and Turner Sports. The new 7-year agreements, which started with the 2021-22 season, pay the league a combined $625 million a year through the 2027-2028 season. The total rights fee of $4.4 billion is more than double the $2.1 billion ($300 million per year) the NHL received from NBC and ESPN in its previous media agreement (4). The NHL signed multiple agreements with sports betting organizations in 2022, including FanDuel, PointsBet, PROLINE+ (Canada), and BetMGM. The American Gambling Association projects the league will receive $216 million in annual revenues from these new partnerships.

Sports betting has provided a huge lift for all four professional sports leagues. As more states have legalized sports betting and online betting has become increasingly popular, sports teams have all raced to take advantage of the fastest-growing fan engagement activity in North America. Leagues and teams have aggressively pursued partnerships with gambling companies. In 2021, the NFL signed a league-wide multiparty, 5-year agreement with Caesars Entertainment as the league’s Official Casino Sponsor and DraftKings and FanDuel as Official Sports Betting Partners. The deal is reputed to be worth “just shy of $1 billion.” (5). The NBA, MLB and NHL have all signed agreements with a broad spectrum of gambling companies, including MGM Resorts, Fox Bet, Fan Duel, William Hill, DraftKings, and Wynn Resorts. Nielsen Insights projects the four North American major leagues will earn a combined $4.23 billion annually from legal sports betting (6). The NFL will be the primary beneficiary, receiving more than half or $2.3 billion of this new annual revenue stream.

“I think sports gambling is the future of our business. I think it’s here, and it’s only going to get bigger. There’s no stopping that freight train now.” Brad Alberts, CEO and President of the Dallas Stars

The magnitude and rapidity of the recovery from COVID-19 by the top professional sports leagues in North America is stunning. Less than two years from the onset of the pandemic in 2020, all four leagues have generated record levels of revenue. The combined revenue is projected to reach nearly $46 billion by the end of 2022, $6 billion more than the 2019 pre-COVID total of $39.6 billion and $17.5 billion more than league totals during the depth of the infection in 2020. In contrast, Europe’s top professional soccer leagues have not fully recovered from the height of the pandemic. In 2022, the combined revenues of the five major leagues totaled $16.5 billion, still $500 million less than the record pre-COVID total of $17.0 billion in 2019. Only the English Premier League’s revenues in 2022 exceeded 2019 levels.

The continued growth prospects for major sports leagues in North America look very promising. All four leagues have secured lucrative, long-term media rights deals. The rapid emergence of streaming services has further expanded the media landscape. The aggressive entry of two trillion-dollar giants, Amazon and Apple, opens the door for an abundant new income stream. Apple began offering MLB games on Apple TV+ this summer at a reported $595 million over seven years. The success of Amazon Prime’s new $8 billion partnership with the NFL to broadcast Thursday Night games this fall is a likely prelude to significantly greater investment by these tech giants.

The leagues’ aggressive embrace of sports betting promises to be the single-most lucrative revenue source. By June of 2022, sports betting revenue totaled $3.04, on pace to eclipse the previous year’s record of $4.23 billion. Morgan Stanley forecasts sports gambling spending to reach $7 billion by 2025, with some industry analysts projecting revenues up to $10 billion (7).

References

1Blake Williams, MLB teams will receive at least $100m annually from TV rights contracts, February 12, 2022. Dodger Blue

2Andrew Buller-Russ, “NBA brings in record high-revenue in 2021-2022 season,” July 16, 2022. SportsNaut

3.Matt Johnson, “NBA reportedly seeking $75 billion,” May 7, 2022. SportsNaut